Home Based Business Tax Deduction

Taking a Job vs. A Home Business

.....Here is an illustration of how significant a home based business tax deduction

.....strategy can really be.

.....When you compare taking a job with starting a home business, the net

.....difference in extra money for your family can be as much as 3.5 times more,

.....using a home based business tax deduction, than working as an employee.

.....Here is a hypothetical situation: Mike and Jennifer are a married couple with

.....two children. Mike is currently employed with an $80,000 per year salary. They are

.....trying to decide if Jennifer should get a job or start a home business to supplement

.....the family income.

.....How can they approach the problem to ensure they are making the right decision?

.....Can they simply compare the amount of income from each source? In that case,

.....taking a job would probably look more attractive. A more in-depth analysis is

.....required to determine the hidden costs of working for wages, and to determine

.....the advantages of a home based business tax deduction.

____________________________________________________TAKING A JOB vs. A HOME BUSINESS

The Advantage of a Home Based Business Tax Strategy

____________________________________________________TAKING A JOB

“I don't know if I can live on my income or not –

the government won't let me try it.”

- Bob Thaves, "Frank & Ernest"

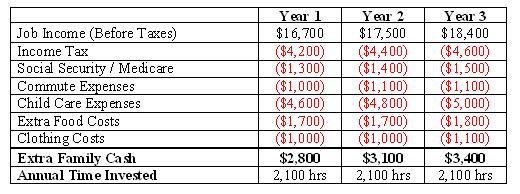

If Jennifer gets a job with a $17,000 annual income, that’s $17,000 a year extra cash for the family right? Actually, not even close. The government and the hidden costs of a new job will make it very difficult. Table 1 below shows how much available extra money she will actually bring in over the next three years, after taxes and expenses whittle away at the income.

TABLE 1

Taking a Job

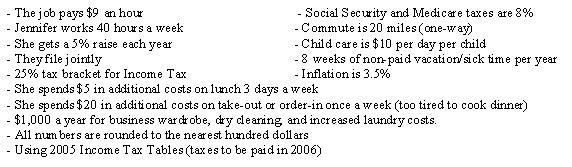

Table 1 Assumptions

After 1 year of working, Jennifer will bring only $2,800 of extra cash to the family after taxes and extra expenses are accounted for. Additionally, she will spend 2,100 hours away from her family.

After 3 years of working, she will bring in a net total of only $9,300 at a cost of 6,300 hours.

____________________________________________________STARTING A BUSINESS

(Utilizing a Home Based Business Tax Deduction)

“There may be liberty and justice for all,

but there are tax breaks only for some.”

- Martin A. Sullivan

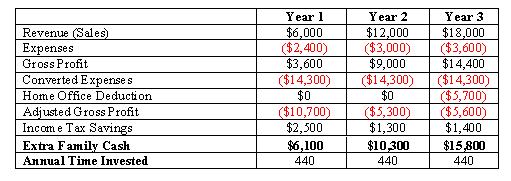

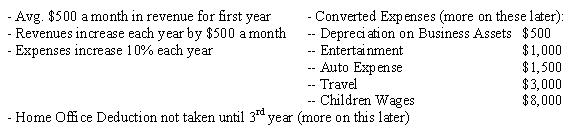

Now, compare the results of a good home based business tax strategy. If a home business brings in $3,600 of profit, that’s only $3,600 of extra money available for the family, right? Not necessarily. Table 2 below shows the available extra money with a home business.

TABLE 2

Home Based Business Tax Strategy

Table 2 Assumptions

Jennifer would bring in $6,300 more cash to the family in the first year (compared to $2,800 with a job). For the entire 3 year period, she would make $22,900 more cash available for your family.

____________________________________________________THE RESULTS

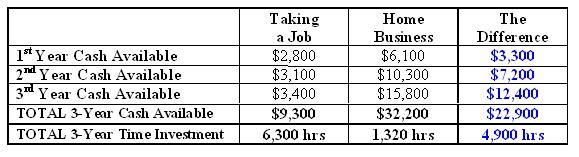

Table 3 below shows a side-by-side comparison of taking a job vs. a home based business tax deduction.

TABLE 3

Results of the Comparison

In the first year, a good home based tax strategy would provide 2 times as much money with ONE FIFTH the time investment. Over the three year period, it would bring in 3.5 times more cash and still only ONE FIFTH the time investment. That’s a combined factor of 16.5 times more efficient because of a home based business tax deduction combined with the time saved.

BOTTOM LINE: You can make as much as 3.5 times the money in one fifth the time investment while still taking full advantage of all the remaining benefits of a home business:

- Spend time with your family

- Be your own boss

- No commute

- Pick your own hours and schedule

- Establish lasting friendships

- Learn business, financial, and people management skills

- RESIDUAL INCOME: Make money while you sleep or go on vacation

Request our FREE Home Business Success Pack to see how powerful a home business can really be.

Click here to return to Home Business Tax Information

____________________________________________________

"Money is important, but I don't

want to spend my life working for it."

-Quote from Rich Dad's CASHFLOW Quadrant

The Perfect Business CD is a 25 minute

audio interview that introduces you to

Robert Kiyosaki and his philosophy on

The Perfect Business.

...and We Want To Give You A Copy Free

Click Here For Your Free Perfect Business CD:

Learn how to Use Home Based Business Tax Deduction Strategies

_________________________________________________________

¦ About Us ¦ Contact Us ¦ Our Partners ¦

¦ Site Map ¦ Links ¦ Home Business Consultants ¦ © Copyright 2005. Home-Business-Expert.com