US Government Social Security:

Will It Be Enough?

Many people are hoping that US Government Social Security benefits will support them in their “golden years”. Unfortunately, they may be wrong. Here’s why:

- US Government Social Security faces an unfunded liability of more than $26 trillion (Source: www.socialsecurity.org).

- The federal government has risen the statutory retirement age (when you can begin receiving benefits) to age 67. Currently, you can start drawing benefits at age 62, but with 25% reduced benefits (for the rest of your life). How many more times will the government raise that age? One organization, the American Academy of Actuaries, recommends the age 72!! They claim that will erase the program's predicted shortfall.

- US government Social Security benefits (after you start drawing them) will be subject to Federal Income Tax if your annual income exceeds $25,000(www.socialsecurity.org).

- It will take up to 20 years (after we start drawing benefits) before we make enough back to break even on the taxes we spent during our working years (CRS Report for Congress, 94-27 EPW Social Security: Facts and Statistics).

- According to the Social Security Administration, the typical 62-year-old man has only a 50% chance of living long enough to break even on his taxes and a woman has a 60% chance (Money Magazine, Dec 2004). The government knows that.

- By the year 2012, the system will be paying out more than it is taking in and the Social Security Trust Fund will be exhausted by 2042.

- The BOTTOM LINE:

Benefits are going to be reduced,

Taxes are going to be raised, or

Probably both.

Elizabeth Jetton, certified financial planner and President of Financial Vision Advisors, Inc. in Atlanta, recommends people discount their expected Social Security benefit by as much as 25%.

________________________________________________________

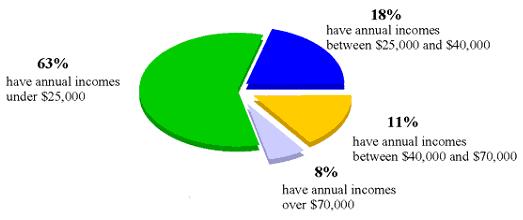

The following chart, from the US Social Security Administration, shows that 63% of people over age 65 (in 2002) had incomes under $25,000 (after Social Security benefits were collected). According to the US Census Bureau, that is just $800 a month above the poverty level for a 3-person household (which is $15,000 a year).

Is US government Social Security merely a modified Ponzi scheme? Every employee is hoping to be on the receiving end at the back door - retirement. The only way for that to happen is if there are enough employees still at the front door, still working and turning in the their money. Is this a scheme that works only as long as there are more people at the front door than the back door?

The victim mentality that currently permeates our society is starting to evolve our national character. We now have too many people who have come to expect the government to solve their problems. Ronald Reagan said one of the worst things you could ever hear is:

“Hi, I’m with the government and I’m here to help you.”

Social Security worked fine when it began in the mid-1930s when the ratio of workers to recipients was 44 to 1. In 2000, the ratio was merely 3.4 to 1. By 2016, US government Social Security will collect less money in tax revenues than it pays out. There will be too many people at the back door.

2016 is also the same year that the baby-boomers start to turn 70 years old. 700,000 people turn 70 in that year alone. And the number of people turning 70 every year will continue to increase with each subsequent year.

The Unites States Census Bureau projects that by 2030 the number of people over 65 will have doubled since 2000. Although living longer is great, the soaring cost of medical expenses are not.

As a result, income tax in the future is going to skyrocket for two reasons:

1) Those that depend on Social Security will soon become a major voting bloc and will vote for younger workers to take care of them. It’s much easier to change the law than it is to change people.

2) The Roth IRA. With a Roth IRA, the government takes taxes up front. When people start to withdraw their funds in retirement, the federal government will not get a cut. Which means it will have to raise taxes to fund it's bureaucracy.

The government is pushing a problem it cannot solve forward onto future generations. Instead of finding and implementing a solution, the government is “passing the buck.”

A 2002 report from the National Conference of State Legislatures detailed how serious the problem of the government’s handling of social programs has become. 28 states have spending overruns and lower than expected taxation returns. The Clinton Administration’s Fiscal 2000 Budget Report stated, “Government trust funds do not consist of real economic assets that can be used in the future to fund benefits.” In other words, the government is finally admitting that there really is no Social Security trust fund.

The overall problem the government is trying to solve is how will people survive when they are no longer able to work.

Why rely on the government to solve the problem? We are supposed to be a nation of independent-minded and freedom-seeking people.

A home business provides a solution to supplement Social Security. Gain the independence and freedom you deserve.

Request our FREE Home Business Success Pack to see how.

Click here to return to

Starting a Small Home Based Business:

Supplement US Government Social Security

____________________________________________________

"Money is important, but I don't

want to spend my life working for it."

-Quote from Rich Dad's CASHFLOW Quadrant

The Perfect Business CD is a 25 minute

audio interview that introduces you to

Robert Kiyosaki and his philosophy on

The Perfect Business. You won't have to rely on US Government Social Security.

...and We Want To Give You A Copy Free

Click Here For Your Free Perfect Business CD:

You Won't Have to Rely on US Government Social Security

_________________________________________________________

¦ About Us ¦ Contact Us ¦ Our Partners ¦

¦ Site Map ¦ Links ¦ Home Business Consultants ¦ © Copyright 2005. Home-Business-Expert.com