The Small Business

Retirement Plan

61% of Americans do not have a retirement plan of any kind (Source:

Money Magazine). A small business retirement plan could allow them to retire in comfort.

Most Americans have no idea:

1) What age they plan to retire.

- The government expects them to retire at age 67.

2) How long they plan to live.

- Life expectancy is 78 for men and 84 for women. (www.heritage.org)

3) How much they will need to maintain their standard of living.

- The residual income from a small business retirement plan could allow them to maintain that standard.

4) How far their nest egg will take them.

- A small business retirement plan can take them through their entire life, and have money left over for their heirs.

5) What assumptions their plan uses.

_______________________________________________________

You cannot question an assumption

you do not know you have made.

More money has been lost, more friendships have been destroyed, more people have been hurt, more accidents have happened, and more people have gone to court because someone failed to question their assumptions.

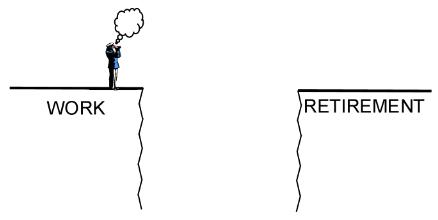

When it comes to a retirement plan, most people lamely say they will “cross that bridge when they get to it.” But, the Retirement Bridge must be built before you get to it. What if, “when they get to it” there is no bridge for them to cross – just a large hole? They will be unable to escape the “rat race”. A small business retirement plan could place them on the “fast track” with residual income all through their “golden years”.

Thanks to technology and medical advances, we are all living longer. Question is: Can we afford to live longer with the corresponding rises in health care costs? No problem if we plan on working all our life. And no problem if we are not one of the 25% of retirees that are too disabled to work (Money Magazine, Aug 2005).

Some may find out at age 65 that their defined contribution plan is inadequate…or insufficient. They won’t know until after they retire, and it may be too late to work and replenish it...to make up the shortfall.

Those without a small business retirement plan or some other source of residual income will still have options:

- Lower their standard of living

- Sell their "assets" (car, house, furniture, etc.)

- Rely on someone else to take care of them – or –

- Work for the rest of their lives, if they can.

Most people will spend their later years of life clinging to tiny little life preservers, in the form of handouts from family and the government. Instead of “waiting for their ship to come in”, a better option is to begin building their ship now with a small business retirement plan. If they do, when the storms come, they will have their own ark...big enough and strong enough, able to withstand any storm at sea.

One of the best ways to lay the foundation for that ark is with a small home business.

Request our FREE Home Business Success Pack to see how.

Click here to return to

Starting a Small Home Based Business:

Your Small Business Retirement Plan

_______________________________________________________

"Money is important, but I don't

want to spend my life working for it."

-Quote from Rich Dad's CASHFLOW Quadrant

The Perfect Business CD is a 25 minute

audio interview that introduces you to

Robert Kiyosaki and his philosophy on

The Perfect Business.

...and We Want To Give You A Copy Free

Click Here For Your Free Perfect Business CD:

Start Building Your Small Business Retirement Plan

_________________________________________________________

¦ About Us ¦ Contact Us ¦ Our Partners ¦

¦ Site Map ¦ Links ¦ Home Business Consultants ¦ © Copyright 2005. Home-Business-Expert.com